Bookkeeping & Reporting Services

Remote Bookkeeping & Reporting Services

Discover a clear path toward growth and success with our remote services.

Remote Bookkeeping for Businesses of All Shapes & Sizes

You have a passion for your business, but doing your own bookkeeping can slow your efforts to grow by stealing attention and focus from your company’s future.

Let NorthStar help. Our remote business bookkeeping experts will provide you with a range of services through cutting-edge tools and a personal touch designed to reduce stress and free up your resources.

Restore your focus on the future and enjoy peace of mind in the present with a highly experienced, reliable, and responsible team guiding you forward.

Our Services Include

Bookkeeping clean-up

Business accounting

Bank & credit card reconciliations

Accounts payable & receivable

Payroll processing

General ledger data entry & reconciliations

Customized financial reporting

Month-end closing

Fiscal year-end support

Quickbooks training & support

Advisory & support

Financial Reports That Tell Your Story

Forging your path forward requires understanding where you have been. Your financial data tells your company’s story in black-and-white—assuming that your books are in order.

Similarly, good business decisions rely on measurable data and objective insights, but these can feel indecipherable without the proper analysis.

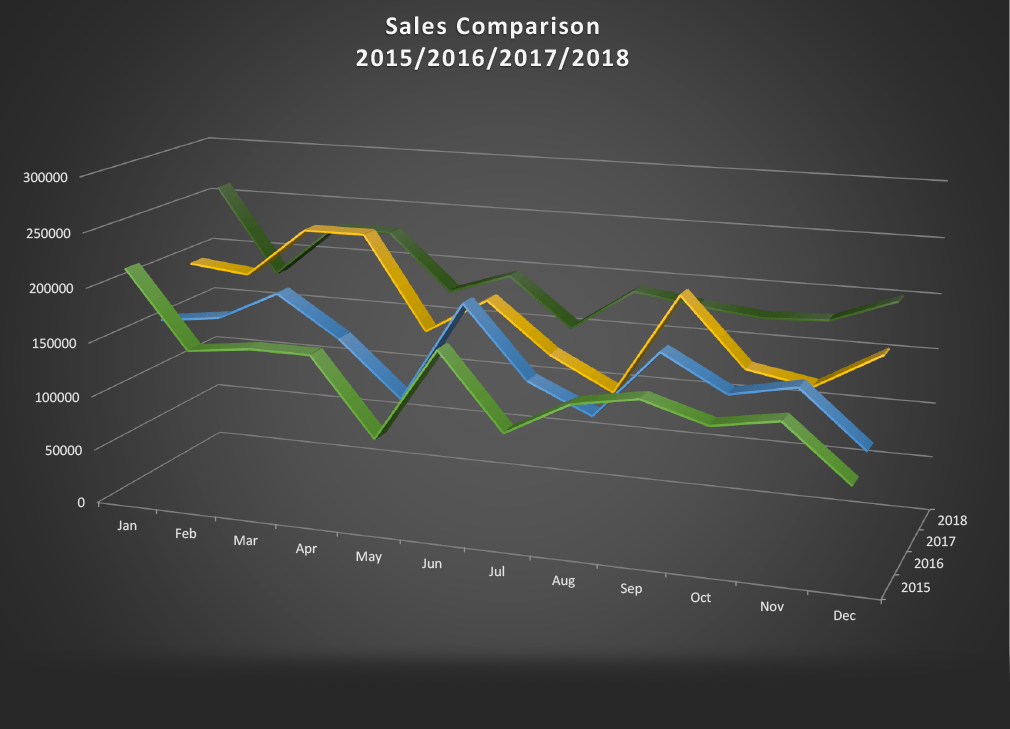

The NorthStar team’s skills include uncovering trends, cycles, KPIs and ROI statistics. Get actionable insights and turn your raw data into a meaningful story that shows where you have been and where you’re headed.

Custom Reports from NorthStar Bookkeeping can include:

Profit & loss statements

Balance sheets

Cash flow statements

Variance analyses

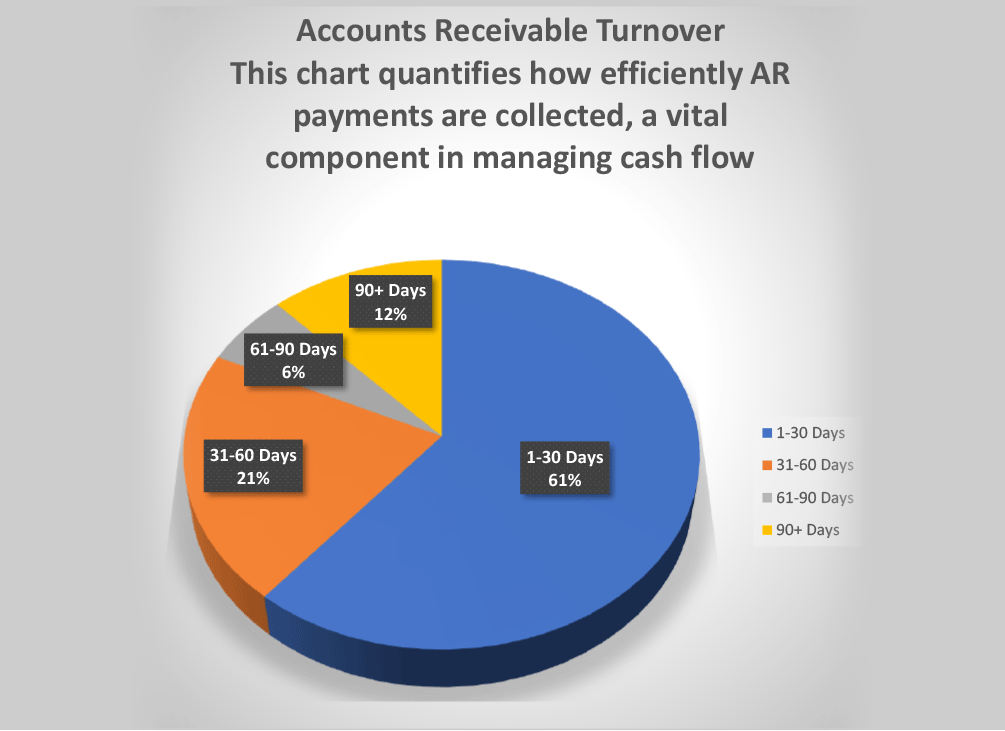

AP / AR aging analysis

Reconciliation

Custom data sets

Remote reporting helps accurately predict cash flow, create budgets, and plan for the future so you can control where your story goes and how it ends.

With NorthStar Bookkeeping, Your Only Direction is Forward.

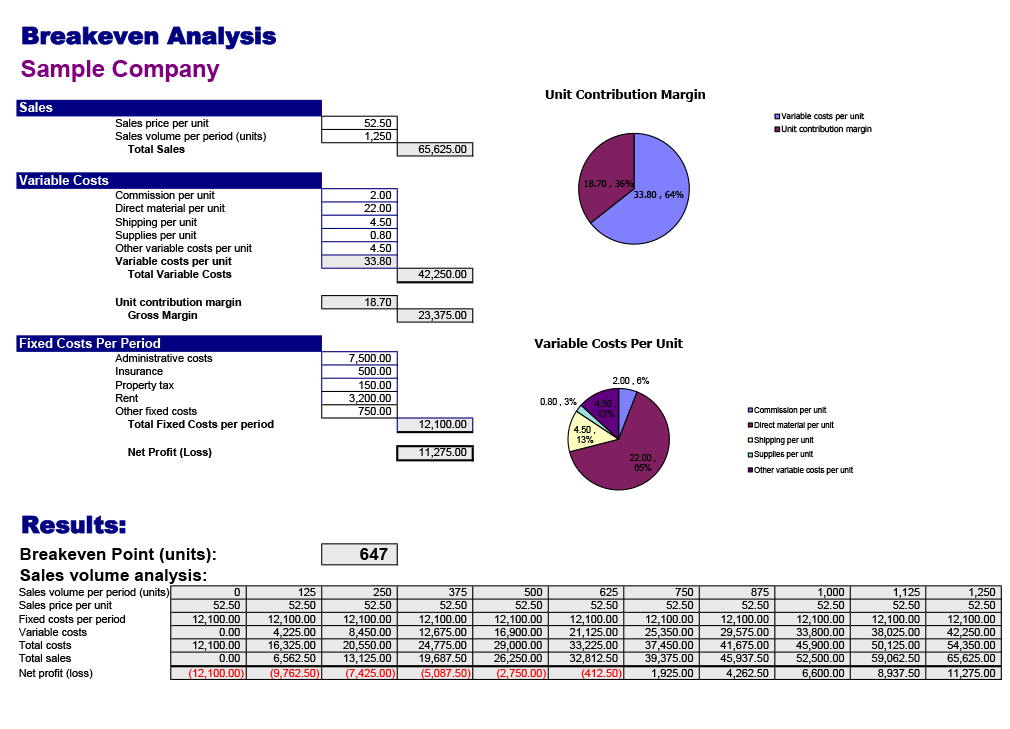

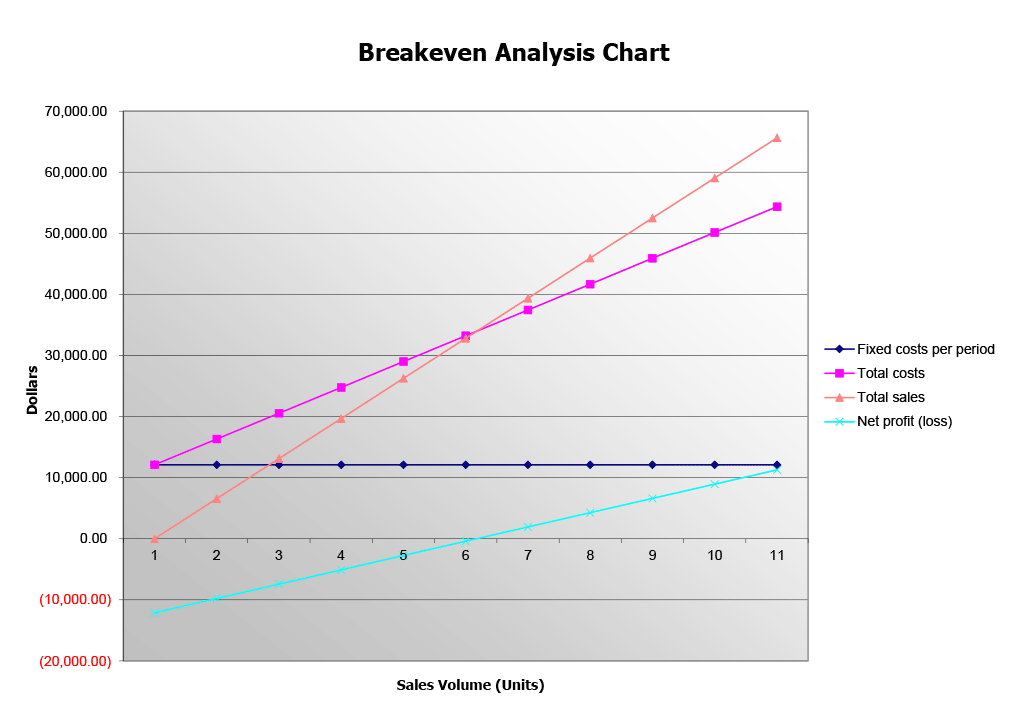

Example Reports

Click on the images of sample reports to enlarge them and review the work we do.

Testimonials

What Clients Are Saying About NorthStar

Client

Experiences

Law Firm

Property Investment Firm

Service Provider

NorthStar News

Move Your Organization Forward With NorthStar

Start your journey with NorthStar by scheduling a conversation.

We’ll map out our next steps together